Hut 8, a Canadian Bitcoin mining company, increased its Bitcoin holdings by 161, a 32.35% decrease from November’s 238 Bitcoins.

Hut 8 also decreased its daily Bitcoin mining output in December from 7.9 Bitcoin/day in November to 5.2 Bitcoin/day on average. As of December 31st, the company had 9,086 total bitcoins.

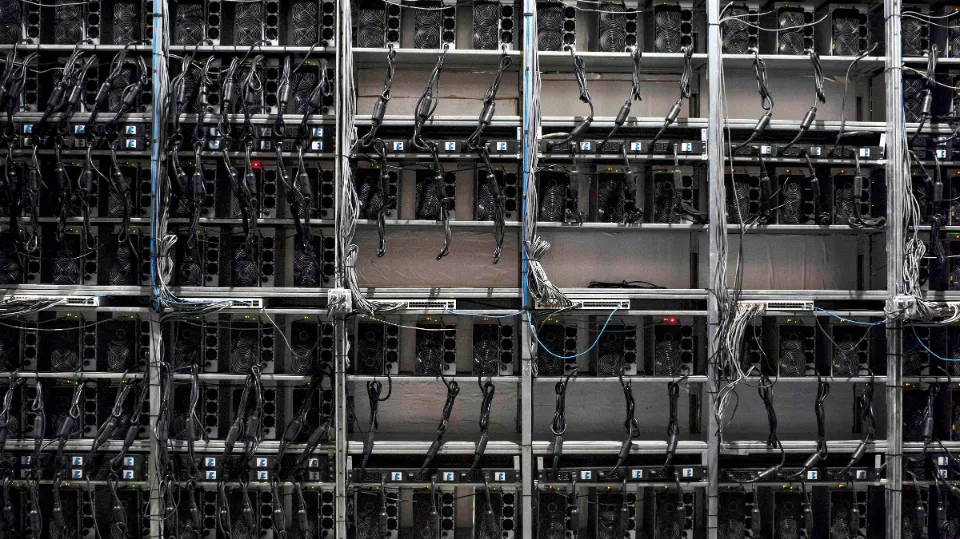

According to reports, the production decline is a result of high energy costs, which compelled the mining company to return power to the supplier. Hut 8 is investigating options for organic and inorganic growth as part of its efforts to lessen the effects of the problems with the energy supplier.

Hut8’s Bitcoin Treasury reached 9,086 thanks to the December production; this is an increase of 65% from its balance at the end of 2021. In accordance with its long-standing policy, Hut 8 deposited all of the self-mined Bitcoin into its custody in December.

Decrease in Revenue in Q3, 2022

Hut 8’s net revenue dropped by $18.6 million, from $50.3 in the third quarter of 2021 to $31.7 in the same quarter of 2022. The Company did, however, mine 982 Bitcoin in Q3 2022, an 8.5% increase over Q3 2021 as a result of the expansion of the Company’s fleet of miners and mining operations.

Hut 8 was one of the few mining companies to increase its Bitcoin holdings in the face of a market downturn as of November 2022. The crypto bear market had a severe negative impact on mining companies. In December YOY, Bitcoin mining revenue decreased by 37.5%, according to CryptoSlate.