After a turbulent year, Bitcoin mining ETFs are once again in the top spots on performance charts for the first month of 2023.

The majority of cryptocurrencies surged to multi-month highs as Bitcoin (BTC) and other altcoins got the year off to a bullish start. In addition to the spot market, Bitcoin also dominates the equity exchange-traded fund (ETF) market, where Valkyrie’s Bitcoin Miners ETF (WGMI) is the top equity ETF and has increased by 40% year to date.

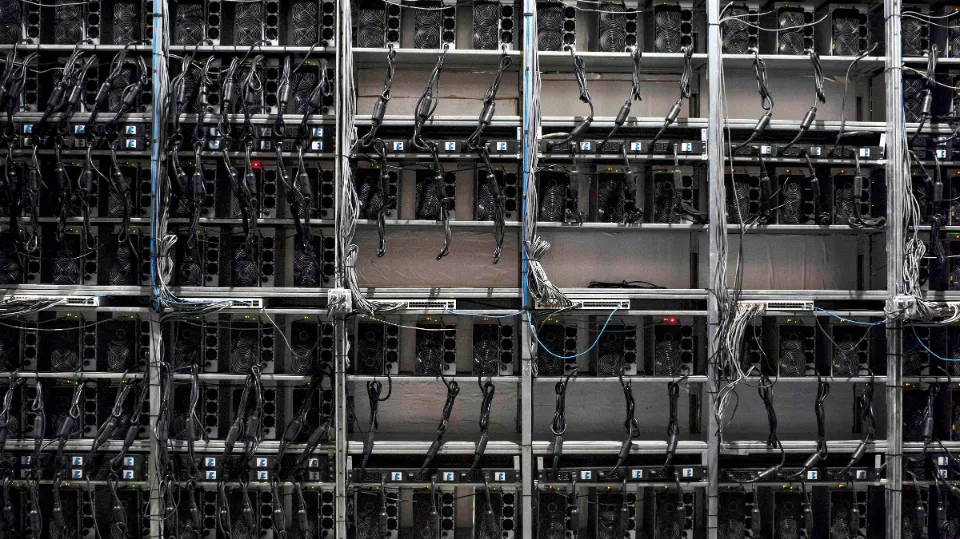

It is unusual for the Bitcoin mining ETF to be leading both the market for leveraged equity ETFs and traditional equity ETFs. Bloomberg senior ETF analyst Eric Balchunas pointed out that the Valkyrie Bitcoin mining ETF is highly “concentrated,” with investment in only 20 firms, including Among other well-known names are Argo Blockchain, Bitfarm, and Intel.

Although it didn’t make direct investments in Bitcoin, the WGMI ETF was listed on the Nasdaq in February 2022. 80% of its net assets offer exposure through the securities of companies that derive at least 50% of their revenue or profits from BTC mining. Valkyrie invests the rest of the 20% in companies holding “a significant portion of their net assets” in Bitcoin.

The ProShares Bitcoin Strategy ETF, which was introduced in October 2021 and tracked Bitcoin prices using futures contracts traded on the CME marketplace, was the first Bitcoin ETF to receive approval in the United States. With a trading volume of $1 billion on its first day, the first ETF saw significant market traction very early on. Many thought that this would eventually persuade regulators to give the first spot market-based ETF their seal of approval in 2022. But a protracted crypto winter and crypto contagions made things difficult for the crypto ETFs.

In 2022, cryptocurrency-related ETFs in Australia and the US became the two worst-performing ETFs, respectively. The four worst-performing U.S. ETFs in order, according to ETF.com in 2022 were crypto-related.

The adoption of cryptocurrencies by the general public was expected to increase with the introduction of crypto ETFs. The protracted bear market and numerous unfavorable events in 2002, however, prevented this.