Solo Mining vs. Pool Mining: Which is better? Weigh the pros and cons of autonomy, rewards, consistency, and control for your cryptocurrency mining endeavors.

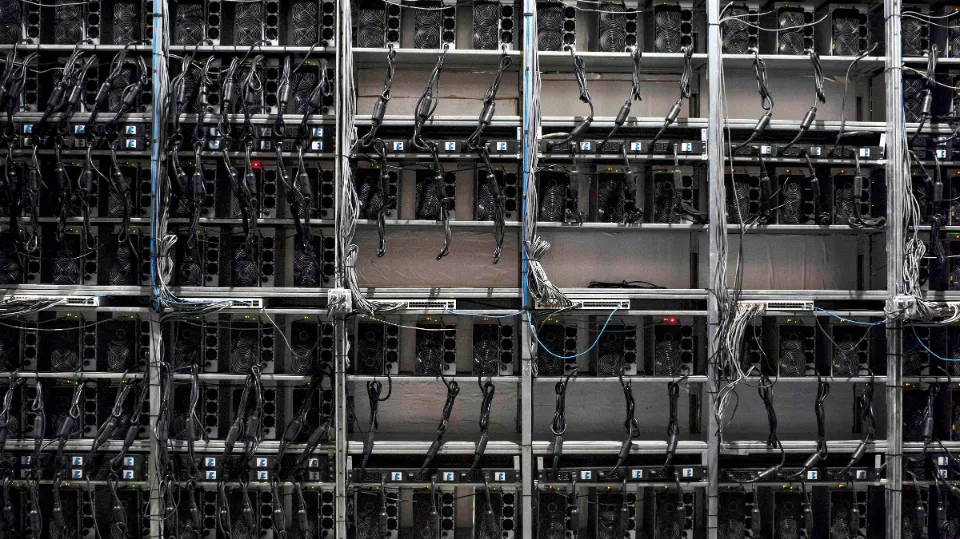

Cryptocurrency mining has become an increasingly popular and profitable venture, with individuals and organizations seeking to earn digital assets like Bitcoin and Ethereum. Two primary methods of mining have emerged: solo mining and pool mining. Solo mining involves an individual miner attempting to solve blocks independently, while pool mining involves a group of miners pooling their resources and sharing the rewards.

With solo mining, the chances of getting a higher long-term yield are more. In particular, when compared to pool mining. Additionally, as solo mining eliminates the need to pay a pool fee or transaction fee, rewards increase over time.

In this blog post, we will explore the advantages and disadvantages of both solo mining and pool mining, helping you determine which approach might be better suited for your crypto mining endeavors.

What is Solo Mining?

Solo mining, as the name suggests, entails conducting cryptocurrency mining alone. This implies that you will be responsible for managing the entire mining operation. When Bitcoin first started, its enigmatic creator Satoshi Nakamoto did it alone. Before GPU, ASIC, and pool mining gained popularity, Nakamoto performed this task using a CPU, which was the industry standard for a while.

You will require all the standard mining equipment and software, as well as a wallet to store your mined tokens or mining rewards if you decide to go it alone.

If you want to mine independently, you’ll also need to run a full node, which can be fairly energy-intensive. This implies that if you start solo mining, your electricity bill might significantly increase. However, will the earnings be sufficient to offset the initial and ongoing costs of solo mining? Let’s find out below.

How Much Can You Earn from Solo Mining?

In summary, solo mining is risky, especially if you’re mining a very well-known token like Bitcoin or Ethereum. Additionally, the overall rewards for mining decline as more and more miners join a blockchain and start working on validating blocks and circulating new tokens.

The income from solo mining is particularly erratic because there is little chance of ever mining an entire block, and some people invest a lot of money in hardware and software with no return. But the reward is significant if you do mine a block.

It is obvious why people are eager to start mining popular cryptocurrencies given that you currently receive 6.25 BTC for mining a Bitcoin block, which is equivalent to almost $300,000. However, it’s crucial to keep in mind that the likelihood of a single person mining an entire block is extremely low.

When you independently mine or validate a block, however, you keep every reward you earn. Additionally, solo mining enables you to avoid paying pool fees when you do receive rewards. When you solo mine, you’ll also be much less likely to experience outages.

Let’s discuss the more common alternative, pool mining, now that we are fully informed about solo mining.

Advantages of Solo Mining:

- Being the sole owner of substantial rewards is one of the biggest and most alluring benefits of solo mining. With pool mining, this is just not feasible. The entire profit will only belong to a solo miner if his equipment discovers the value of a new block before anyone else.

- There are very few chances of interference from outages when mining alone. Additionally, this could lead to higher uptime.

- Solo miners do not have to pay any additional fees. A solo miner actually receives 6.25 Bitcoin plus transaction tax for finding each new block.

- The likelihood of obtaining a higher long-term yield is greater when mining alone. Particularly when we contrast it to pool mining. Furthermore, as solo mining eliminates the requirement for paying a pool fee or transaction fee, rewards increase over time.

- The effects of pool timeouts do not apply to solo miners. Therefore, a backup pool can be set up by lone miners.

Disadvantages of Solo Mining

- the requirement for a sizable amount of capital to begin and carry out solo mining.

- the chance of losing all of your reward money at once if another miner or miners with faster computers decide to take part in solving the specific block you are investing your resources in.

- the potential of never having as much computing power as a miner group.

- Miners who invest in well-known cryptocurrencies like Bitcoin run a high risk of losing their entire investment.

- The income generation is typically more erratic when mining alone.

- Due to the fact that solo mining only supports network pull, miners often waste valuable time.

What is Pool Mining?

In some ways, pool mining and solo mining are very similar, but the former involves mining with other people, while the latter is done by one person. Individual miners pool their resources to increase their chances of mining a block during the pool mining process. By using the proof of stake mechanism, they function similarly to staking pools.

In other words, having a lot of computing power overall increases your chances of being successful. But to participate in a mining pool, you must be a miner and own the required hardware. Thus, pool mining is comparable to solo mining in that regard, and joining a mining pool won’t help you avoid the up-front costs of cryptocurrency mining. The reward is divided among the pool’s members after a successful block has been mined and paid out.

Yet not all mining pools are created equal. You could sign up for a proportional mining pool, where participants who contribute computing power receive shares until a block is located and successfully mined. Then, according to how many shares they own, miners receive rewards. This implies that you won’t get a lot of rewards when a block is mined if you don’t contribute much computing power to the pool.

Pay-per-share pools, also referred to as PPS pools, function similarly to proportional pools. According to the amount of energy they contribute to the pool, miners continue to receive a certain number of shares. However, even if a block is not mined, these pools still pay out instant flat rewards to members.

Peer-to-peer, or P2P, mining pools are the final option. These emphasize decentralization and employ a unique pool blockchain that forbids pool operators from acting in their own self-interest and aids in preventing network failures brought on by a single flaw.

In any case, when a pool mines a block, the rewards are frequently not distributed equally, and the miners who contribute more processing power receive a larger payout. Before deciding to join a pool, keep this in mind. Let’s get to the crucial part now: can solo mining earn you as much money as mining in a pool?

How Much Can You Earn from Pool Mining?

Despite the possibility of enormous rewards, solo mining does not provide the same level of security as mining pools. The frequency with which you receive a payout will probably be higher than if you were mining alone because pool members pool their computing power and increase the likelihood of finding a block.

The payouts you do get from pool mining, however, will be less than what you’d get from mining a block independently. The two mining techniques thus exhibit some reciprocity. Choose pool mining if you value consistency and dependability. Solo mining is an option to consider if you’d rather take a chance on a potentially large payout.

Advantages of Pool Mining

- Pool mining offers members the benefit of generating more consistent income.

- Long polling is advantageous for miners in pool mining because it allows them to earn 1% to 2% more money.

- The variety of crypto coins available to miners in pool mining is extensive. They thus gain the advantage of being able to switch between different crypto coins, assisting them in selecting the best ones for trading.

Disadvantages of Pool Mining

- Pool mining increases the likelihood of challenges from outside parties at the pool provider.

- Additionally, pools have other security flaws and are vulnerable to DOS attacks. The configuration of the pool mining can, however, be changed by members.

- The platform fees are largely covered by the money that miners earn from pool mining. Additionally, it takes a very long time to recover transaction fees.

- Attackers are drawn to pool mining because there is a lot of currency storage there.

Which Mining is Better: Solo Mining Or Pool Mining

People favor consistency and stability when it comes to their financial situation. In the context of cryptocurrencies, these two ideas are debatable. But earning and trading new cryptocurrency every day would be much safer than being in the dark for more than five months. Solo mining requires a lot of patience without any assurance of success, even though pool mining involves risk.

However, your preference and financial situation will determine what you choose. If you have millions to invest, consider going solo; otherwise, joining a pool would be preferable.

Additionally, all of the well-known cryptocurrencies are seeing a rapid increase in hash complexity. The difficulty of solving ETH and BTC has increased by 30 and 4 times, respectively, in the last year. Dash now has hash codes that are 150 times more complex.

The majority of miners were aware that mining alone would be extremely difficult even at the start of the mining industry. As a result, we can see that the majority of them are pool mining, combining their equipment capacities. Together, they have been receiving more consistent and equitable compensation.

You will never, however, be able to earn the full reward price as a pool miner because the rewards you receive decrease with the number of miners in the pool.

Analyzing Capital Requirement and Profitability of Solo Mining

Furthermore, the hash rate complexity is increasing to an unbelievable level as a result of the involvement of a large number of participants. Additionally, there is almost no chance of finding such a unit on your own. In fact, let’s look at the amount of money needed for a lone miner to mine bitcoins in a network with a high hash rate of 1 pth per second. Miners will have to keep their farms running at a capacity of about $200k to accomplish this. Keep in mind that this expense excludes supply and electricity costs.

Therefore, with a 95% chance, you will need to work consistently for about 200 days. Then, you can discover a block value and receive 12.5 Bitcoin as payment. Noting how large this sum actually is, you will profit from it.

Furthermore, this network will become more complex over the next few days. Therefore, it will be necessary to have almost 100 times more capacity in order to continue discovering new blocks every day. Millions of dollars in capital investment will be required for the entire process.

Closing Thoughts

Choosing between solo mining and pool mining depends on various factors, including your technical expertise, available resources, desired level of control, and risk tolerance. Here’s a summary of the main points discussed:

Solo mining offers autonomy, control, and the potential for higher rewards. It allows you to have complete control over your mining operations and privacy. However, it also comes with increased difficulty, longer periods without rewards, and less consistency in payouts.

Pool mining, on the other hand, provides consistent payouts, reduced variance, and lower entry barriers. By joining a pool, you can enjoy more predictable earnings and a steadier income stream. Pool mining is suitable for those who prefer a more stable and regular reward system, especially for miners with limited resources or experience.

When deciding which method is better for you, consider your goals, available resources, and risk tolerance. If you have significant computational power, technical expertise, and are willing to take on the challenges of solo mining, it could potentially yield higher rewards in the long run. However, if you prefer a more reliable and predictable income stream with lower barriers to entry, pool mining might be the better option.

Ultimately, some miners may choose to alternate between solo mining and pool mining based on market conditions, the specific cryptocurrency being mined, and personal preferences.

Remember to thoroughly research and choose reputable mining pools if you decide to go the pool mining route. Look for pools with a good track record, fair fee structures, and strong security measures to safeguard your earnings.

In conclusion, both solo mining and pool mining have their advantages and disadvantages. The decision of which method is better depends on your individual circumstances, preferences, and goals. Understanding the pros and cons of each approach will help you make an informed decision and maximize your mining potential. Happy mining!

FAQ

Is Solo Mining Better Than Pool Mining?

Even though solo mining has the potential to yield enormous rewards, it cannot guarantee a steady income as mining pools can. The likelihood of finding a block is increased because pool participants pool their computing power, so you will probably receive payouts more frequently than if you were mining alone.

Is Pool Mining More Profitable Than Solo Mining?

Mining in a pool is equivalent to mining alone before costs. At the same difficulty, there is no difference in the likelihood of a pool or lone miner discovering a block. Therefore, regardless of the difficulty, pool mining is always less profitable over time.

Can You Make Money in Solo Mining?

Additionally, the hardware hash power and the network’s overall hash rate have a significant impact on solo mining. However, solo miners were making a sufficient profit at a time when the hash rate complexity was lower. In addition, fluctuating cryptocurrency prices and high electricity costs have an impact on profitability.