The Bitcoin network now has the highest level of difficulty ever. The United States regulatory crackdown, however, has caused asset prices to decline.

It is now more difficult than ever to secure the next block because BTC mining difficulty is at an all-time high.

To find the following block, miners must perform 39 trillion hashes (39T). The difficulty is often referred to as a measure of competition between Bitcoin miners, or the computational power required for another block to be produced.

Mining difficulty has increased by 47% since the same time last year, according to BitInfoCharts. This has put a lot more pressure on miners.

Bitcoin Mining Metrics Latest

Furthermore, Bitcoin mining hash rates are also very close to their peaks. Bitinfocharts currently reports a hash rate of 300 EH/s (exahashes per second), just below its peak of 316 EH/s from late January.

Furthermore, since February 2022, hash rates have increased by 50%. For network security, this is good news, but for Bitcoin miners, it’s bad news.

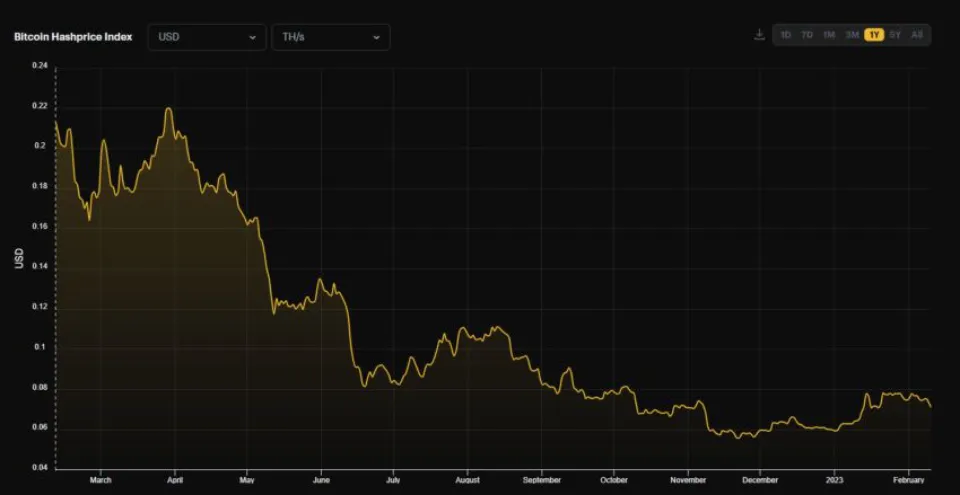

Mining profitability has fallen to multi-year lows as a result of these rising metrics. Mining profitability has fallen 66% since February 2022 to its current level of about $0.073 per day per terahash per second.

Furthermore, Hashrate Index refers to this metric as “hashprice.” According to the analytics system, hash prices fell to an all-time low of $0.055 in late November 2022. During the bull market peak in late 2021, they were as high as $0.40.

BTC Hash Price | Hashrate Index

Bitcoin miners are currently facing a triple whammy of low BTC prices, high difficulty, and hash rate, and increasing energy costs.

Researcher on bitcoin mining Jaran Mellerud has found that some public mining companies have spent more than half of their profits on administration. Most likely to survive the storm are those who have been more thrifty in this area.

On Feb. 9, mining firm CleanSpark released its fiscal Q1 earnings report. Despite a decline in revenue, the company was confident that this year would see more mergers and acquisitions.

Hut 8 additionally disclosed a merger with US Bitcoin Corp earlier this week.

Price Outlook

Today’s depreciation of the price of bitcoin increased the pressure on miners. As the SEC cracked down on Kraken’s crypto-staking services, the market fell.

At the time of publication, the price of BTC had fallen to $21,870, a decrease of nearly 4% over the previous 12 hours. Additionally, the asset has now lost 7% over the past week as the bears resume pressurizing markets.

BTC/USD 1 week – BeInCrypto