Private bitcoin miner Gryphon Digital intends to go public through an all-stock merger with publicly traded cannabis company Akerna (KERN).

After the transaction closes, the new company will operate under the Gryphon name and have its headquarters in Las Vegas, Nevada, the statement said. The shareholders of Akerna will own about 7.5% of the new publicly traded entity, while the current equity holders of the miner are anticipated to own about 92.5%.

The newly appointed CEO of the publicly traded company will be Rob Chang, CEO of Gryphon. Six of the final seven directors of the new company will be chosen by Gryphon, with Jessica Billingsley, the CEO of Akerna, serving as one of them.

Vanguard (2.6% ownership as of Sept. 2022), Perkins Capital (2% as of December) 2022) and (1.2% as of September) BlackRock Fund Advisors 2022), according to FactSet data.

The agreement was reached after Gryphon ended its protracted process to become publicly traded by way of a reverse merger with publicly traded data management company Sphere 3D (ANY). The proposed transaction was first revealed in 2021, but due to the protracted regulatory approval process, the closing date was postponed several times before the transaction was finally cancelled.

Last year, Gryphon was also embroiled in controversy after Sphere 3D agreed to pay $1.7 billion to an unidentified mining rig manufacturer called NuMiner. The mining industry closely examined the deal after several concerns about NuMiner’s viability were raised.

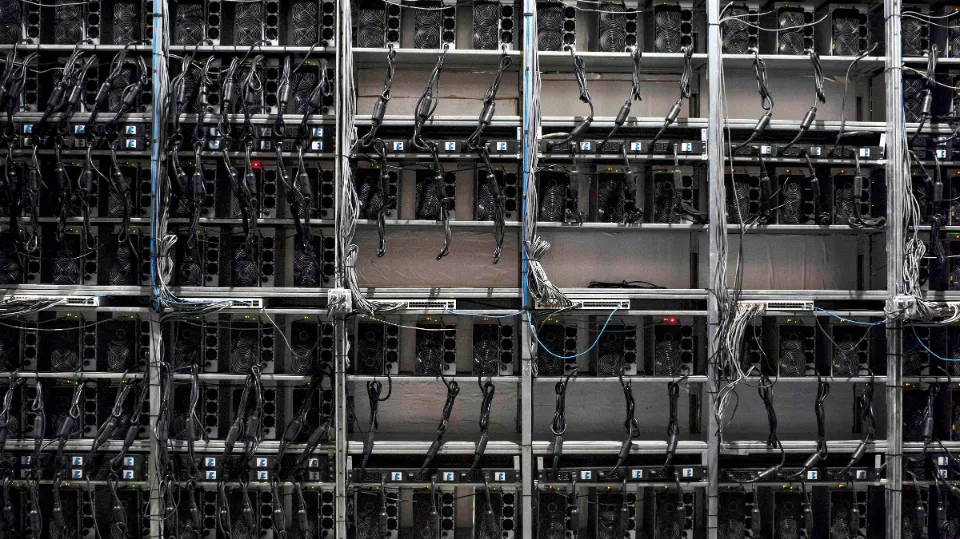

According to the statement, Gryphon, which began operating as a miner in September 2021, has a potential revenue-generating profile of 1.1 exahashes per second (EH/s) on a cost basis of 0.75 EH/s.

Akerna’s stock, which was trading at around $1.51 per share, experienced a 15% decline on Friday. TradingView estimates the market value of Akerna to be around $8 million.