On January 11, Hashrate Index, a platform for analyzing Bitcoin mining data, published its 2022 Bitcoin Mining Year in Review, which examined the performance of the cryptocurrency in 2022 by examining its hashprice, hashrate, prices, mining stock performances, etc.

The Chinese reporter Colin Wu updated his Twitter account Wu Blockchain with the reports from the Hashrate Index on the hashprice of Bitcoin:

According to Hashrateindex data, Hashprice reached a three-month high of $78 as Bitcoin’s price crossed the 21,000 US dollar mark. When determining how much a miner can expect to make, the term “hashprice” is used to describe the expected value of 1 TH/s of hashing power per day. — Wu Blockchain (@WuBlockchain) January 15, 2023

Wu pointed out that the hashprice of the coin hit a 3-month high of $78/PH/day, while its price “broke through 21,000 US dollars”.

Bitcoin Hashprice Index

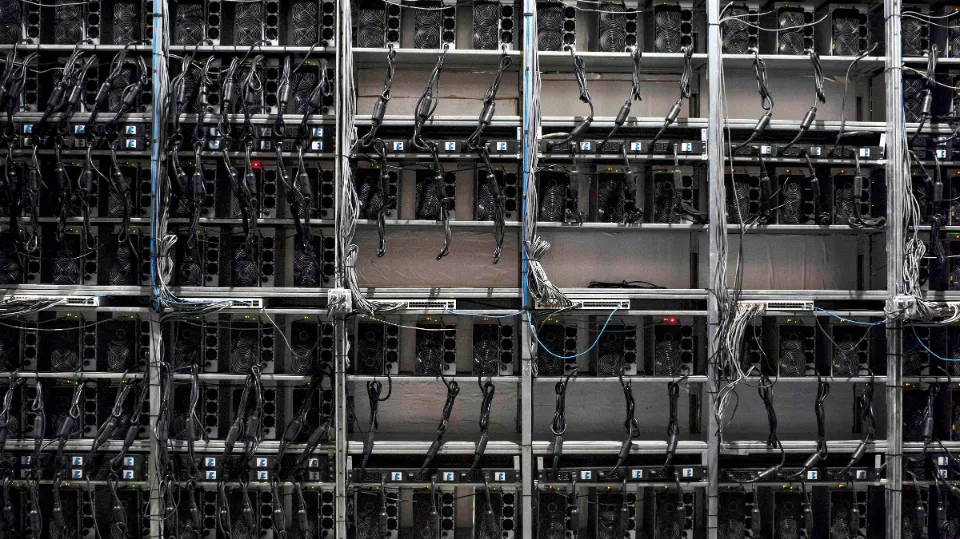

According to reports, even though the hashprice is at a 3-month high right now, it is still extremely low when compared to last year. While the bull market of 2021, was “an extremely profitable time to mine Bitcoin”, especially because Different circumstances that led to China’s ban on Bitcoin mining.

Notably, the average hashprice for 2021 was $314.61/PH/day. Additionally, the daily high for the year reached $412.57/PH. The USD hashprice high in 2022 was only $246.86/PH/day, however, and things were completely turned around. The hashprice once dropped to an all-time low of $55.94/PH/day, despite the fact that it was $123.88/pH/day on average.

The platform defines hashprice as the expected value of 1 TH/s of hashing power per day:

The expected value of 1 TH/s of hashing power per day is known as hashprice, a term coined by Luxor. The metric measures the expected profit a miner can expect from a particular hashrate level.

Bitcoin Price and Difficulty

In addition, Luxor provides the bitcoin community an opportunity to foresee the difficulty for the miners to “find the next Bitcoin block in the chain”, by showcasing the Chart of Bitcoin Price Difficulty. Luxor’s Bitcoin price is an index price that is calculated by “taking the Data on the price of bitcoin from various exchanges, as calculated using the volume-weighted average price (VWAP).